Timothy B. Lee / Ars Technica

The massive computing power of high-end consumer graphics cards make them ideal for mining Ethereum and a number of lesser-known cryptocurrencies. (Bitcoin's simpler mining algorithm long ago came to be dominated by custom ASICs, making GPU-based bitcoin mining unprofitable.) As a result, the cryptocurrency boom that began last year led to a boom in demand for graphics cards.

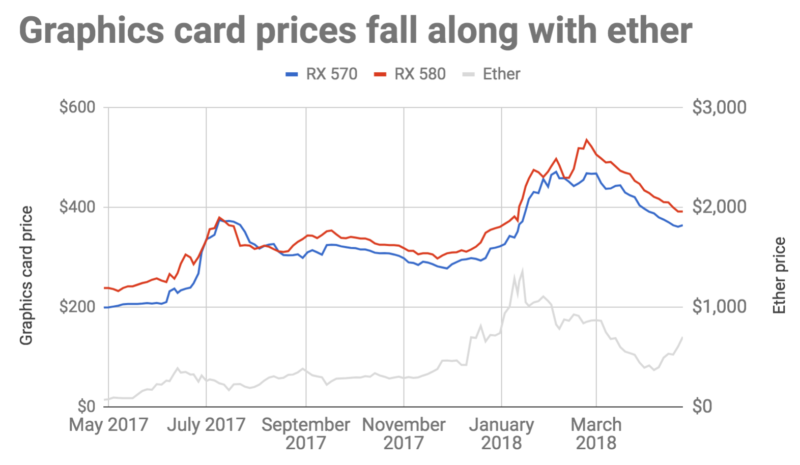

Prices soared last summer, then soared even more in early 2018. By February, the going rate for high-end graphics cards like the Radeon RX 570 and RX 580 was more than double what it had been nine months earlier.

But now the graphics-card boom seems to be coming to an end.

The price of ether and other major cryptocurrencies has been trending downward since January. And since February, graphics-card prices have generally been heading in the same direction.

"Profits have dropped quite a bit," one Ethereum miner told Ars by email. "The video-card shortage seems to be mostly over."

Another miner agreed: "The card shortage is definitely over."

When I visited the graphics-card aisle of my local Best Buy in January, I was confronted with bare shelves where the most powerful graphics cards were supposed to be:

Timothy B. Lee / Ars Technica

When I returned to the same store on Friday, there were several Radeon RX 570 and RX 580 graphics cards for sale:

Timothy B. Lee / Ars Technica

It's hard to see in that first picture, but one of those price tags shows Best Buy asking $529.99 for a Radeon 580 with 8GB of memory. And even at that price, they weren't available.

"It's not available in any store," a Best Buy staffer told me in January. "It's not online."

Today, Best Buy lists the same card for $419.99—and it's actually available for purchase!

I didn't see any high-end Nvidia cards like the GeForce 1070 and 1080 on the shelves. It's not clear if that's because these cards are in shorter supply globally or just happened to be unavailable at my particular store. But price data from PC Part Picker shows these high-end Nvidia cards have also been on a downward price trajectory since February—albeit a less dramatic one.

Two reasons the GPU price slump is likely to continue

The big question, of course, is whether recent price declines will continue in the coming weeks. As you can see in the chart above, ether's value has been on a bit of a tear recently, rising from less than $400 to more than $600 over the last month. But it's still way below the January peak of almost $1,400—and so mining still isn't nearly as profitable as it was earlier this year.

"Unless Ethereum price goes way up, you are better off buying ETH from exchange than buying a GPU to mine with it," an active Ethereum miner told me by email. "I expect prices of GPUs to continue dropping."

At the same time, a couple of big changes on the horizon could undermine demand for graphics cards for Ethereum mining even if the price of ether goes back up.

First, Bitmain, a leading maker of custom bitcoin-mining gear, announced the release of ASIC mining hardware custom-designed for Ethereum.

Like bitcoin, the Ethereum network automatically makes mining more difficult as more computing power is added to the network. So the introduction of powerful and energy-efficient custom ASICs could increase the amount of computing power required to produce one unit of ether. And that, in turn, could reduce the yield from GPU-based mining rigs—perhaps even below the cost of the electricity required to run them.

That's far from certain, however. Ethereum's mining algorithm is designed to be "memory hard" precisely to prevent it from being dominated by a few big miners using custom chips like bitcoin is. And because of that, Ethereum founder Vitalik Buterin has expressed skepticism that Bitmain's Ethereum mining rigs will produce the kind of dramatic performance gains that bitcoin-mining ASICs produced a few years ago.

There's a bigger threat looming on the horizon for GPU-based Ethereum miners, however. Ethereum developers are working on a new approach to mining called "proof of stake." Both bitcoin and Ethereum currently use a model called "proof of work" where miners' ability to produce new coins is proportional to available computing power. But the Ethereum project is planning to shift to a "proof of stake" model where miners gain influence over the mining process by locking ether up in escrow.

The shift to a proof-of-stake model will take at least a few months—and probably longer. But if it's completed, it would dramatically reduce demand for graphics cards for Ethereum mining, since mining rewards would no longer be proportional to computing power. And Ethereum is by far the most valuable cryptocurrency that can be mined profitably with graphics cards, so this could have a big impact on the overall market.

Read More Why this year's insane graphics-card price surge might be over : https://ift.tt/2KrGjOaBagikan Berita Ini

0 Response to "Why this year's insane graphics-card price surge might be over"

Post a Comment