Both Ripple and Bitcoin are on the top of the crypto sphere, but have a lot of differences. This ultimate comparison will show you their strong and weak sides.

Just a year ago, Bitcoin was considered to be the sole king of cryptocurrencies: its enormous market cap and overwhelming price attracted investors. However, in 2018, it wasn’t the most desirable piece of cake: tables turned in favor of revolutionary altcoins with advanced blockchains behind them. Ripple has slowly but steadily turned into Bitcoin’s main competitor: it breathes down its neck and is predicted to cast Bitcoin from the throne.

How do Ripple and Bitcoin differ, and which cryptocurrency would be a better investment? This ultimate blockchain comparison is here to guide you through the mire of differences.

Bitcoin: The Backbone of Cryptocurrency

Bitcoin was the first cryptocurrency to gain popularity: it was introduced in 2009 by the mysterious Satoshi Nakamoto (still no one knows who this person or group of people are). This digital cryptocurrency is based on blockchain technology: data is stored in a distributed ledger and is spread across multiple nodes. It means that once information is registered in the chain of blocks, it cannot be erased or forged. The public ledger mostly serves to verify transactions and keep records. Bitcoin is maintained by a team of enthusiastic developers. This decentralized system is not governed by any third party, be it governments or banks.

Bitcoin can be mined. Miners contribute their processing power to verify the transactions and add them to the Bitcoin blockchain. Besides, they find new Bitcoins. At the dawn of Bitcoin development, one BTC cost a few cents, and mining was a no-brainer: those who mined or bought Bitcoin and held for a few years became very rich down the road (Roger Ver is a good case in point).

Today, Bitcoin is mostly viewed as a means of storing money. At the same time, it’s gradually becoming a real-life payment method. Many eCommerce websites and even brick-and-mortar businesses have introduced payments in Bitcoin.

Ripple: Blockchain For Bank Infrastructure

Ripple was developed by the Ripple company, founded in 2012. In 2015-2016, the company had offices in the UK, Australia, and Luxembourg. Right from the start, Ripple has been positioned as a system for banks and payment networks. It serves for payments settling, currency exchange, and international money transfers. The main idea behind Ripple is to provide a system for the direct transfer of any assets (digital money, gold, fiat, etc) that can be settled in real time and would be a cheaper and more secure alternative to transfer systems used by traditional bank systems (for instance, SWIFT).

Unlike Bitcoin, Ripple doesn’t use blockchain: instead, its distributed consensus ledger uses the network that validates server and the proprietary currency called XRP. Ripple is a token that’s used within Ripple network to drive money transfers between various cryptocurrencies. The existing banking systems use fiat currency like dollars and euro for performing conversion to other currencies, which takes a lot of time and incurs high exchange fees. Typically, transfers between banks take up to 1-3 days to be processed.

Therefore, Ripple has a lot of advantages:

-

It allows converting a lot of different currencies almost instantly

-

It reduces fees considerably (the cost of a transaction is a small fraction of cent).

-

It ensures the security of transactions.

Ripple has already received support from corporate investors and is being slowly integrated into international banks. For example, the Commonwealth Bank of Australia, Fidor Bank, Santander, and over 61 Japanese banks said they were preparing or already implementing applications that work on the Ripple Network payment system.

Note that Ripple is not a mineable asset. All the coins are already created: Ripple emitted 100 bln XRP at its inception to reward participants for providing computing power for the maintenance of the blockchain. According to statistics, during the first month of escrow, only 100 mln XRP was used, and 900 put back into escrow.

Consensus Mechanisms

What makes the day-and-night difference between Bitcoin and Ripple is the underlying consensus mechanisms.

Bitcoin: Proof-of-Work

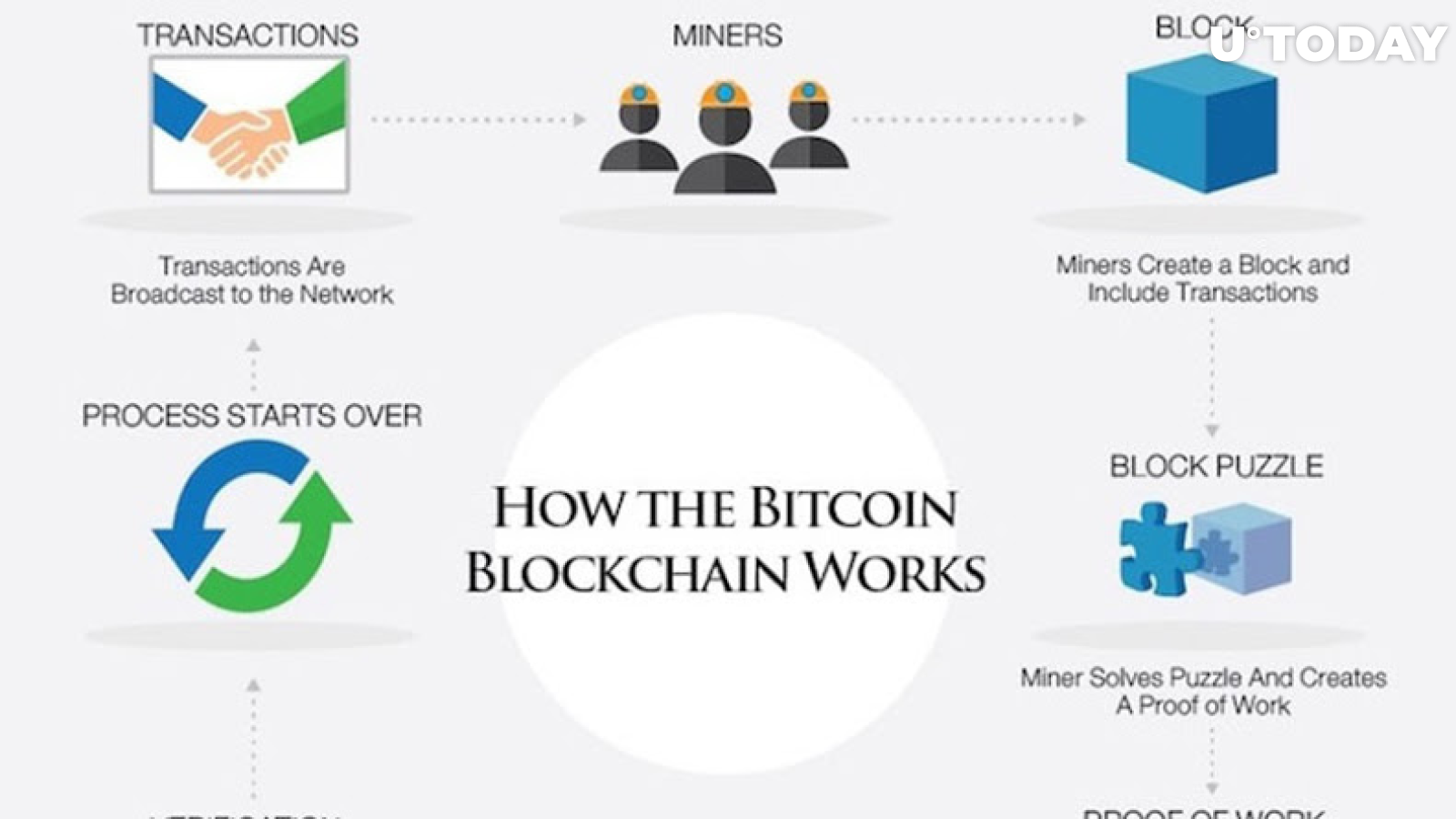

Bitcoin’s blockchain was the first to use the consensus mechanism. It was created by Bitcoin’s developer and is called Proof-of-Work. What the heck is this? Think of Proof-of-Work as a difficult calculation.

The Bitcoin network generates calculations that are too difficult for humans and require a lot of computational power to be solved. Such calculations take 10 minutes, and once it’s done, the Bitcoin transaction is confirmed as valid.

Who performs calculations? Every node connected to the Bitcoin network competes with others to be the first device to solve the calculation. The person who does it first is given a Bitcoin mining reward. The main drawback of the Proof-of-Work model is the need for a huge amount of electricity. One independent study has shown that Bitcoin mining consumes as much electricity as 159 individual nations!

Another problem with Bitcoin is that it Proof-of-Work and mining require very expensive hardware, which means the reward goes to the people who can invest more money into better ASICs and equipment.

Last but not least is the fact that the Proof-of-Work model has a lot of deficiencies, such as low transaction processing speed, low scalability, and high fees.

Ripple: Federated Byzantine Agreement

Ripple’s consensus mechanism, Federated Byzantine Agreement, serves to reach consensus between various nodes. In this system, every node is tied to a limited number of a few other nodes – together they form a so-called “Circle”. The Ripple network has a huge amount of circles, and they overlap, so there is a well-established connection between them.

Transactions are checked by Transaction Validators (this technology is deployed by banks): they are selected individually and are accredited before being able to engage in the activity of verification. That means banks won’t be willing to manipulate consensus as they might be serving their own transactions. But even if they did, all other transaction validators would see it and cancel the transaction.

The FBA consensus mechanism isn’t made to solve complex calculations, so it requires much less electricity than Bitcoin. That makes the system more efficient and ensures that transaction fees are kept at the optimal level. As a rule, about 80% of validators need to reach the consensus for the transaction to be marked as valid.

Now that you know how both cryptocurrencies differ by the mechanism used, it’s time to take a closer look at the practical implementation of these assets.

Where to spend both cryptocurrencies?

Bitcoin is quickly turning into a versatile means of payment. It’s not just a means of crypto trading: you can spend the digital currency in regular stores, too. The list of retailers accepting Bitcoin is large:

|

Store |

What can you buy with Bitcoin? |

|

Overstock.com |

Online retailer for buying tech, furniture and any other stuff using cryptocurrency (BTC, ETH, Dash, LTC, and other assets are accepted). |

|

Shopify |

A versatile online store – you can buy anything |

|

eGifter |

Gift cards for different stores (Amazon, Home Depot, JCPenney, Sephora, etc). |

|

Dish |

Subscription-based TV provider |

|

PizzaForCoins |

Pizza delivery from different companies (Papa John’s, Domino, Pizza Hut) |

|

Microsoft |

Software, games, movies, and apps on Xbox and Microsoft store |

|

CheapAir |

Flight booking |

The list of retailers accepting BTC can go on, and on, and on – their number is growing exponentially.

What about Ripple? In fact, Ripple was never designed to serve as a method of payment. There are a few online stores that accept XRP tokens, but things are changing quickly: some stores that used to handle Ripple payments once do not longer accept it. The primary aim of Ripple was a transfer of other currencies and commodities (such as oil or gold) over its proprietary network. The transaction fee is calculated in XRP, so it serves as fuel.

Key differences between Bitcoin and Ripple

We've already understood that Bitcoin and Ripple have different natures. Let's underline the key points.

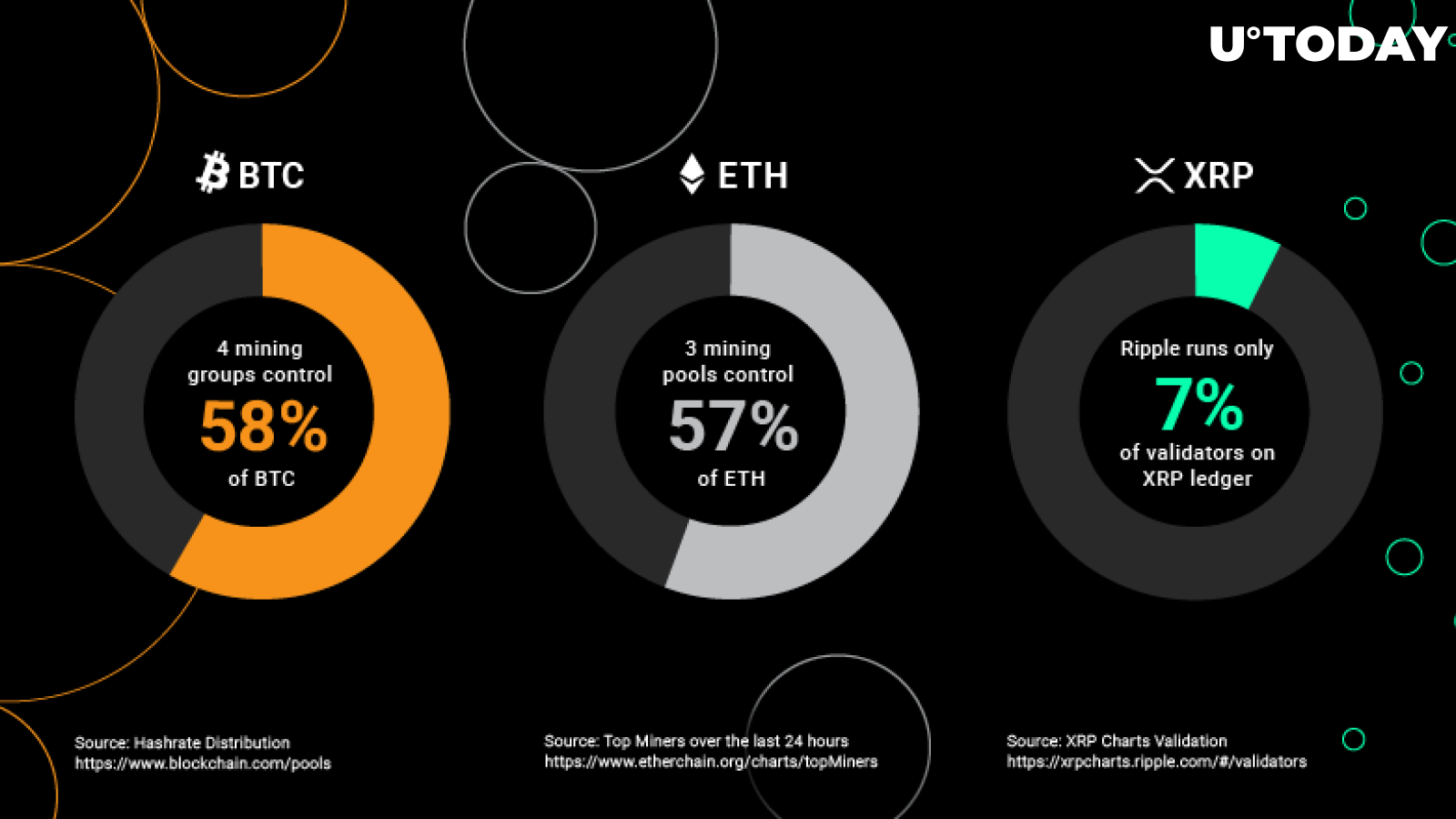

Level of decentralization

Bitcoin is an open-source network, and a highly decentralized one. It's the community that makes decisions and develops the network. To prevent irreversible splits, developers use so-called soft forks: backward-compatible changes to the system’s use that allows avoiding breaks in the network. Yet, half of Bitcoin power is used to prevent irreversible hard forks.

Ripple is developed by a private company, and its internal ledger is closed – no third party is allowed to change it. The company uses a consensus approach, which allows for quicker updates. Thanks to the amendment system, developers find consensus before changing the network. Typically, when an amendment gets 80% in two weeks, all future ledgers have to support it.

Many people blame Ripple for being highly centralized – the network is managed differently, and no third party has access to the code. But let's not forget that this asset was initially designed to be a commercial solution. Today, about 75% of customers implement it commercially. About 62% of the XRP supply belongs to the company staff.

Transaction time

From a speed standpoint, Ripple is definitely superior to Bitcoin.

Bitcoin processes about 7 transactions per second. Due to lack of scalability, the transaction cost equals about $27, and each operation takes about 70 minutes to clear. That's too slow, though developers hope to solve the problem with the help of the Lightning Network.

As for Ripple, it uses so-called "off-ledger" processing, so one transaction settles within a mere 4 seconds. Another unbeatable advantage is the fact that Ripple charges a 0,00001 XRP transaction fee to maintain the functioning of the network. Add to that the ability to handle 1,500 transactions per second, and you will see why Ripple has made its way to the top.

Reserve coins

Every self-respecting crypto project is expected to have reserve coins. Satoshi Nakamoto is reported to have 980,000 BTC, though it cannot be proven for sure. It’s just a hypothesis because the crypto community is sure the founder should have access to his coins to be confident in his creation.

Ripple is similar to Bitcoin in this relation: the company holds a huge amount of XRP. It’s said to possess 60% of the overall coin supply. Some claim it’s too much, but the company doesn’t release more coins.

Pros and Cons of Ripple and Bitcoin

To continue comparing Bitcoin and Ripple side by side, let’s observe the pros and cons of each cryptocurrency.

Bitcoin

Pros: Bitcoin is the largest crypto asset by market capitalization. It has gained acclaim during the 10 years of its existence and only continues gaining popularity. It sets the standard for the entire industry and, probably, has the largest crypto community supporting it.

Cons: Bitcoin’s got a very low transaction processing speed and limit, and is inferior to its analogs as a transactional currency. There are many blockchains that perform way better than Bitcoin and were created specifically for these purposes.

Ripple

Pros: Ripple is getting more popular among banks and it is set to revolutionize the international payments sphere, making the process efficient and quick. Ripple also has a strong backup – the list of its partners is growing at an exponential rate, and many global financial institutions are eager to implement it in their infrastructure. Therefore, Ripple will grow and increase its coverage.

Cons: Ripple has a lot of strong competitors – it has to compete with SWIFT, Visa, and banks to get to the top. Banks have well-established infrastructures that have been developed for decades, so many people prefer relying on the existing payment processing systems, and changing this habit would be difficult. Time will show whether global banks will adopt Ripple’s technology.

Bitcoin and Ripple from an investment standpoint

What about the exchange and trading opportunities? Here, both cryptocurrencies differ to a great extent, too.

Bitcoin

Investing in Bitcoin is a no-brainer: you can purchase it on any cryptocurrency exchange or even from usual people using any preferable payment method, from cash to credit cards and online payment wallets. Bitcoin is easily accessible for everyone.

But whether you need to purchase and invest in Bitcoin is another question. Of course, it is still one of the largest and oldest cryptocurrencies, but it lost about 60% of its value in 2018 and remains on the level of $3,000-4000 in the last few months. The crypto community doesn’t know whether it will rise ever again, or whether it will beat last year’s lowest threshold.

When should Bitcoin be considered a cryptocurrency for investment? Take a risk in the following cases:

-

You’ve got money and can afford to lose it, if things go bad.

-

You are an experienced trader who isn’t prone to panic selling.

-

You keep an eye out for cryptocurrency prices 24/7 and can react quickly...

-

...Or you believe in Bitcoin’s potency and are ready to hold it for months, or even years.

The last reason to buy Bitcoin is to use it for online payments, for instance, when you want to preserve anonymity.

Ripple

We witnessed the enormous growth of Ripple in 2017-2018 – it managed not just to survive through the bearish market wave, but even strengthen its positions and become the world’s 2nd largest cryptocurrency by market cap, drawing ahead of Ethereum.

Ripple attracts new customers, and the growing number of XRP tokens can trigger XRP price growth. However, XRP is not as easy to purchase as BTC. Many cryptocurrency exchange platforms have XRP as one of their offerings, but you cannot obtain it with fiat currencies – you have to buy Ethereum or Bitcoin first.

Is Ripple a worthy investment? The vast majority of crypto experts agree it has a lot of potential and might be a wise investment with a high ROI. However, you should conduct your own research. Find more information about the technology and its use cases, and make your own decision.

Bottom Line

Now let’s take a closer look at the main differences between the two cryptocurrencies and blockchains.

Breakdown of Ripple vs Bitcoin comparison

|

Bitcoin |

Ripple |

|

|

What was it made for? |

Regular payments that are made safe and transparent |

Currency exchange, international transfers within banking infrastructure |

|

Ownership |

Public |

Private |

|

Transaction cost |

$25-50 |

Less than $0.01 |

|

Can be mined? |

Yes |

|

|

Energy consumption per transaction |

~250 kWH |

Minor |

|

Algorithm |

Proof-of-work |

Consensus |

|

Speed |

~1 hour |

3-5 seconds |

|

When you should invest in it? |

When the crypto market expects a bull run, and you are ready to keep tabs on the prices regularly. |

When you want to make a long-term investment. |

|

Numbers* |

Circulating supply: 17 493 100 BTC Market cap: $62 595 770 506 Price: $3 578,31 |

Circulating supply: 41 040 405 095 XRP Market cap: $13 098 461 863 Price: $0,319160 |

* as of 01/20/2019

Comparing Ripple and Bitcoin isn’t the best idea since they have completely opposite philosophies and principles, and were created with different aims. Ripple won’t be used in the way Bitcoin is, but it doesn’t diminish its value and doesn’t mean Bitcoin isn’t worth considering as a currency for holding.

Ripple has a strong backup from numerous partners, so there are a lot of bright prospects ahead. It has a solid foundation and can revolutionize the global payment sphere. XRP holders can reap huge benefits down the road.

As for Bitcoin, it doesn’t seem to lose its popularity on the cryptocurrency market – it still rules the industry. When developers manage to solve scalability issues and reduce transaction costs, we will witness a new wave of hype and growth. Increased adoption in the financial sector contributes to its further growth and real-time implementation.

Read More What Cryptocurrency Can You Still Mine with GPU/CPU on Your PC in 2019? - U.Today : http://bit.ly/2RZhOKQ

Bagikan Berita Ini

0 Response to "What Cryptocurrency Can You Still Mine with GPU/CPU on Your PC in 2019? - U.Today"

Post a Comment